Articles

|The FORUM

|Law Library

|Videos

| Fraudsters & Co.

|File Complaints

|How they STEAL

|Search MSFraud

|Contact Us

occurs post loan origination when mortgage servicers use false statements and book-keeping entries, fabricated assignments, forged signatures and utter counterfeit intangible Notes to take a homeowner's property and equity.

Articles Updated 042124

Top 10 States with the Highest Number of Commercial Foreclosure in March 2024

According to ATTOM’s newly released U.S. Commercial Foreclosure Report, there is a persistent uptrend in commercial foreclosures over the years, starting from a minimum of 141 in May 2020 and reaching 625 in March 2024. This signifies a consistent rise over the entire period.

Articles Updated 041424

Taking on the housing crisis in Massachusetts could include foreclosure prevention program

We need more affordable housing. This is something I hear over and over as state representative throughout my district of Somerville and Medford. When speaking with a group of high school students from my district recently, I asked about their top priority – it was housing. Is this a typical concern for teenagers? This is where we are today.

Families also need protections now. I am also working to include a policy I filed to create a Massachusetts foreclosure prevention program that would require lenders to engage in conferences with homeowners to review all available prevention options well before an impending foreclosure. Losing a home to foreclosure is devastating for a family, especially when alternatives might have been available but were not explored. This would provide protections for homeowners and go a long way to stopping unnecessary foreclosures.

A crisis of this magnitude requires a number of bold policy ideas. The housing crisis also requires us to work together as communities to support people in need of housing. I look forward to working with constituents to continue to take on the housing crisis in Somerville, Medford and throughout Massachusetts.

Christine Barber is state representative for the 34th Middlesex District, which includes Somerville and Medford.

Articles Updated 040724

Housing Market 2024: 5 States With the Highest Foreclosure Rates

Housing Market 2024: 5 States With the Highest Foreclosure Rates

Foreclosure rates are on the rise. As of February, there were nearly 33,000 properties in foreclosure, an 8% increase from the year prior, according to a new report from ATTOM.

Articles Updated 033124

Billionaire Larry Fink of BlackRock, Which Grabbed Fed Bailouts in 2020-2021, Lectures Struggling Seniors on Making More Sacrifices

Yesterday, billionaire Larry Fink, Chairman and CEO of the giant investment manager BlackRock, released his annual letter to shareholders. In it, Fink revives the same ole trope that billionaires Kenneth Langone and Stanley Druckenmiller were taking on a road show in 2013. Back then the billionaire propaganda was called: “Generational Theft: How Entitlement Spending is Stealing Opportunity from America’s Youth.”

Every time there is talk of raising taxes on the super-rich, some of whom pay less in taxes than plumbers and teachers through a tricked-up tax dodge known as “carried interest,” the billionaires launch a concerted effort to scapegoat struggling seniors living on an average monthly Social Security retirement benefit of $1772.51.

The inability of younger Americans to save enough for retirement couldn’t possibly have anything to do with Wall Street gobbling up two-thirds of lifetime retirement savings in fees, as Frontline documented back in 2013. The late John Bogle explained in the program that if a person works for 50 years and receives the typical long-term return of 7 percent on their 401(k) plan and Wall Street’s fees are 2 percent, almost two-thirds of their retirement account will go to Wall Street. Wall Street On Parade checked the math and documented it for our readers.

Articles Updated 032424

ICE: Mortgage Delinquencies Fell in February as Loan Performance Remained Strong

The U.S. mortgage delinquency rate fell to 3.34% in February, a decrease of 1.29% compared with January and down 3.24% compared with February 2023, according to ICE Mortgage Technology’s First Look report.

While the number of borrowers one payment behind rose modestly by 10,000, those 60 days late as well as those 90 or more days past due both fell to their lowest levels in three months.

Overall, the report paints a picture of ongoing strong loan performance.

About 1.782 million residential properties were delinquent (30 days or more past due but not in foreclosure) in February, a decrease of about 21,000 compared with the previous month and down about 29,000 compared with a year ago.

Articles Updated 031724

Wall Street Mega Banks Have Drawn a Law-Free Zone Around Themselves – The Media Is Complicit

From revoking the American people’s right to a jury trial in matters involving Wall Street; to brazenly thumbing their nose at anti-trust law; to trading the stock of their own bank in the darkness of their own dark pools; to forming their own stock exchange; to committing serial felonies without being criminally prosecuted or having their bank charters revoked – Wall Street mega banks have drawn a law-free zone around themselves and are more dangerous today than they have ever been in U.S. history.

Articles Updated 031024

Another Challenging Week

However, probably the most excruciating part of the week was the case I argued before the United States District Court for The District of Massachusetts, before the Honorable Judge Young, William G. (“Judge Young”).

Judge Young is actually quite famous as the Judge that heard the infamous New Bedford Masachusetts “Big Dan’s” rape trial involving a horrific incident in 1983. This later became the subject of the 1988 movie “The Accused” starring Jodie Foster.

Those not familiar with the subject of foreclosure, or having only superficial exposure to mortgage foreclosure view the subject superficially as merely a loan that is not being paid, and therefore the “deabeat” must be “kicked to the curb”.

However, in the brave new world of “mortgage securitization”, most times the original lender that the borrower took the loan out from, very quickly (usually within 3 months) “sold” the “loan” into the secondary mortgage market.

A detailed description of the “securitization processs” would be well beyond the limited writing space available here. However, that said, the process involves myultiple transfers (sales) of “the right to payment” from the (Note [“loan”]).

The reason for this is the “securitization” is set up to be “bankruptcy remote”. That is the process wanted to insure the “institutional investors” [end user] purchasers that the stream of payments from the underlying notes would not be affected should one of the links in the chain go bankrupt.

However, the “geniuses” who set up the “securitization paradigm” failed to truly grasp the concept that there are mainly two different types of “mortgage theory” jurisdictions in the United States. These two types of jurisdictions are known as “Lien Theory”, and “Title Theory”. There is also an “Intermediary Theory”, in which 11 States use a “blending” of Lien and Title Theory, see the breakdown here.

A very brief explanation describing these theories is that in a “Title Theory” mortgage jurisdiction when you undertake a mortgage, you actually deed/convey the [defeasible fee] title to your property to the “lender” [to secure the Note], but retain the “right of redemption”, which is that if you pay off the Note, the title to the Property is then conveyed back to you. However, in a “Lien Theory State”, the borrower retains their title, and the lender possesses a lien that can be enforced upon default.

Articles Updated 030324

What Is a Mortgage Servicer, and How Do You Avoid a Shady One?

Your mortgage lender can sell the servicing of your loan to a different company. You can’t stop that, but you can protect yourself.

Q: Here at Ask Real Estate, we recently received a reader’s question about poor treatment by mortgage servicers. Many first-time home buyers don’t realize that the lender that approves their mortgage could turn around and sell the servicing rights to a company they’ve never heard of. Now the homeowner might have to deal with a mortgage servicer that has bad customer service, charges late fees when it shouldn’t, or makes needless demands on borrowers. How can you protect yourself from having to do business with a bad mortgage servicer?

A: A mortgage lender is a company that loans you money, but it isn’t necessarily the one that manages your loan. That’s a mortgage servicer, and unfortunately, you cannot choose your servicer. They’re responsible for sending statements, accepting payments and managing escrow accounts. They also charges various fees, many of which they keep, and can initiate foreclosure. Loan servicing can always be sold.

“There is no incentive for good customer service,” said Sarah B. Mancini, co-director of advocacy at the National Consumer Law Center.

Articles Updated 022524

These Charts Reveal Why the Fed Is Frightened about Capital Levels at the Wall Street Mega Banks

According to Federal Reserve data dating back to July 3, 1985 – a span of close to 39 years – there has not been a time when the largest 25 banks were bleeding deposits on the scale that has been happening for the past 22 months.

There has also never been a time comparable to the last 22 months when the largest 25 banks were bleeding deposits while the smaller banks were growing deposits. (See the chart above.)

To get our minds around today’s situation, we made another chart using Federal Reserve data dating back to 1998 – the year before the Glass-Steagall Act was repealed. It shows that the ratio of deposits of the 25 largest banks to the smaller banks stood at 3 times in 1998 and has shrunk to its lowest level of 2.03 times as of February 7 of this year.

Articles Updated 021824

Thousands of vets fell victim to a bait-and-switch...by the VA? Lawmakers want a fix

Lawmakers summoned the head of the Department of Veterans Affairs' loan program, John Bell, to Capitol Hill this week and asked him to explain how the VA is going to fix a debacle that's left many vets in danger of losing their homes.

His answer: They don't know yet.

"We are looking for a solution to be able to help 40,000 borrowers stave off foreclosure," Bell told them.

The VA has been scrambling since an NPR investigation revealed that it pulled the plug on a key program while thousands of vets were still in the middle of it – effectively turning a well-meaning pandemic aid effort into a bait-and-switch trap for homeowners.

At issue is what's called a COVID mortgage forbearance. Set up by Congress after the pandemic hit to help people who lost income, it gave homeowners with federally backed loans a sanctioned way to skip mortgage payments. The missed payments would get moved to the back of the loan term so when homeowners got back on their feet they could just resume their normal payments.

But in October 2022, the VA abruptly ended a crucial part of its forbearance program, stranding tens of thousands of vets who were told they now needed to come up with all the missed payments at once.

Articles Updated 021124

CFPB Secures $12 Million From Ringleaders of Foreclosure Relief Scam

WASHINGTON, D.C. – The Consumer Financial Protection Bureau (CFPB) today announced that it resolved an appeal in a long-running enforcement suit against a foreclosure relief scam operation for $12 million in consumer redress and penalties. Consumer First Legal Group, LLC and four attorneys, Thomas G. Macey, Jeffrey J. Aleman, Jason Searns, and Harold E. Stafford, charged millions of dollars in illegal advance fees to financially-distressed homeowners for legal representation the defendants promised but did not provide.

Articles Updated 020424

Lawmakers move to help veterans at risk of losing their homes

The chairmen of the U.S. Senate's Banking and Veterans Affairs committees introduced a bill Thursday to help veterans at risk of losing their homes because of a COVID-assistance program that the VA ended abruptly in 2022.

The bill, which they call the "Veterans Housing Stability Act," would let the Department of Veterans Affairs restart the program, which thousands of veterans used to skip mortgage payments when they faced pandemic-related financial problems.

"Our veterans earned their home loan guarantee benefit, and they deserve a viable option to get back on track with payments and keep their homes," said Sen. Jon Tester, a Montana Democrat and chairman of the Veterans Affairs Committee. He sponsored the bill along with Sen. Sherrod Brown, an Ohio Democrat who heads the Banking Committee.

Articles Updated 012824

The Battle Over Capital at the Mega Banks Must Expand to Breaking Them Up

Last Thursday, 12 Democrats in the U.S. Senate sent a deeply insightful letter on a subject most Americans have never discussed around their kitchen table: adequate capital levels at the Wall Street mega banks that came close to bringing down the U.S. financial system in 2008. Before that financial crisis was over – the worst since the Great Depression of the 1930s – millions of hardworking Americans had lost their jobs and millions more had their homes taken in foreclosure.

If the U.S. is going to avoid a replay of that crisis, Americans are going to have to start having these critical conversations about the structure of Wall Street mega banks around the kitchen table. Americans are going to have to start engaging in the battle to shape the future of American democracy and more equitable wealth distribution, which requires dramatic reform of the mega banks on Wall Street.

Articles Updated 012124

Amid Collapsed Demand for Existing Homes, Prices Drop Further, Supply Highest for any December since 2018, New Listings Come out of the Woodwork

Housing market is frozen, people have gone on buyers’ strike, sellers are hoping that this too shall pass.

By Wolf Richter for WOLF STREET.

The median price of existing single-family houses, condos, and co-ops in the US whose sales closed in December dropped to $382,600, down by 7.5% from the peak in June 2022, according to data from the National Association of Realtors (NAR) today.

This puts 2023 on record as the first year since the Housing Bust when the seasonal high in June was below the seasonal high (and all-time high) a year earlier. Given the price surge in the spring 2023, the median price was 4.4% higher than in December a year ago.

In another unusual development, prices have dropped every month since June – it’s unusual because seasonally, before the pandemic, there were upticks and flat spots in October through December periods, the little hooks in the chart (circled). There were no such upticks or flat spots in 2022 and 2023, prices fell right through that October-December period (historic data via YCharts):

Articles Updated 011424

Out Today: A Deep Dive into the Dark Side of Banking and Its Handmaiden, Central Banks

Last September, speaking at a conference sponsored by the nonprofit watchdog, Better Markets, to examine if “too big to fail” banks had materially changed in the fifteen years since the 2008 financial collapse, Anat Admati, Professor of Finance and Economics at Stanford Graduate School of Business, offered her assessment of the U.S. banking system: “Corruption has become the system.”

Today, Admati’s celebrated 2013 book, The Bankers’ New Clothes: What’s Wrong with Banking and What to Do about It, co-authored with German economist Martin Hellwig, is being released in an expanded new edition. It is a must read for every American who is bold enough to remove their media tinted, rose-colored glasses and take a hard look at how the U.S. banking system got into the mess it’s in today.

Articles Updated 010724

U.S. Money Supply Hasn't Done This Since the Great Depression, and It Usually Signals a Big Move to Come in Stocks

KEY POINTS

Sizable dips in M2 money supply have occurred only five times in 154 years. The prior four instances were accompanied by deflationary recessions and a steep rise in unemployment.

On top of M2 declining, banks are notably tightening their lending standards.

Investor perspective changes everything on Wall Street.

Motley Fool Issues Rare “All In” Buy Alert

For the first time in nine decades, M2 money supply is meaningfully declining.

Over multiple decades, Wall Street is a surefire wealth creator. When compared to the annualized returns of housing, gold, oil, and even bonds, the stock market easily has these asset classes beat over long periods.

But things get a bit dicey when the lens is narrowed and investors examine the performance of the broader market over a couple of years or a few months. Since this decade began, the ageless Dow Jones Industrial Average (^DJI 0.07%), benchmark S&P 500 (^GSPC 0.18%), and growth-driven Nasdaq Composite (^IXIC 0.09%) have alternated between bear and bull markets in successive years. This volatility has investors wondering what's next for the stock market.

Articles Updated 122423

Articles Updated 123123

Family Found Dead in 27-Room Boston Mansion Faced Foreclosure, Filed for Bankruptcy Last Year

The Massachusetts husband and wife who were found dead along with their 18-year-old daughter in an apparent domestic violence case recently faced significant financial woes, including foreclosure on their 27-room mansion in a wealthy Boston suburb, according to reports.

Articles Updated 122423

Mortgage lender vs. servicer: What’s the difference?

Key takeaways:

- Mortgage lenders fund a home loan, while mortgage servicers handle the ongoing administration of the loan after funding, including repayment and loss mitigation, or payment relief.

- It’s important to know your mortgage servicer and keep track of any changes to ensure it sends payments to the correct place. If you auto-pay your mortgage, this might not be necessary.

- You can find out who is servicing your loan by checking your mortgage statement.

Articles Updated 121723

Some Senate Democrats Move to the Dark Side for Jamie Dimon & Company’s Front Group

A Wall Street cartel of lobbying groups has launched their fiercest anti-regulation battle with Congress since it was in the midst of writing the Dodd-Frank financial reform legislation of 2010. That legislation hoped to address the worst Wall Street abuses and corruption that brought on the crash of 2008 – the most devastating financial meltdown since 1929 and the Great Depression. (See our report: Meet the Banking Cartel that Is Planting the Seeds for the Next Banking Panic and Bailout.)

Articles Updated 121023

Post-Pandemic, Homeowners of Color Face Losing Homes

California homeowners of color already face many threats to their family home. Now, more will risk foreclosure than ever as millions of dollars in pandemic-era mortgage relief is set to run out before they even know it’s there.

At a Thurs., November 2 briefing co-hosted by Ethnic Media Services and Housing and Economic Rights Advocates (HERA), housing attorneys and mortgage experts explained how homeowners can keep their family homes against these threats, while homeowners of color shared their personal experiences of struggling to preserve generational wealth.

Threats facing homeowners

Joe Jaramillo, a senior attorney at HERA, a statewide housing legal service and advocacy nonprofit, said the main threats facing vulnerable homeowners are “keeping the family home when a parent or grandparent passes away; financing Property Assessed Clean Energy (PACE) programs which risk the borrower’s home if unpaid; and “zombie” second mortgages “that haunt borrowers with unexpected bills and threats of foreclosure.”

Articles Updated 113023

The U.S. Treasury’s Financial Crisis Warning Bell Didn’t Ring Before the Repo Crisis of 2019 or This Year’s Bank Runs

The Office of Financial Research (OFR) is a unit of the U.S. Treasury Department. OFR was created as part of the Dodd-Frank financial reform legislation of 2010 to keep the Financial Stability Oversight Council (F-SOC) informed about emerging threats that have the potential to spread contagion throughout the U.S. financial system — as occurred in 2008 in the worst financial crash since the Great Depression.

Articles Updated 112623

Foreclosure Whirlwind: Report Unveils A Tale Of Contrasts

The latest snapshot of the U.S. real estate landscape reveals a nuanced pattern of foreclosure filings.

Real estate data firm ATTOM's October U.S. Foreclosure Market Report shows a 6% decline from September, suggesting a respite; the report also underscores a 6% increase compared to the same period a year ago.

The dynamics reflect a delicate balance with signs of improvement slightly tempered by persistent challenges, creating an environment where homeowners, lenders and policymakers must navigate a complex intersection of economic forces.

The report found there were 34,472 foreclosure filings encompassing a range of stress indicators, including default notices, scheduled auctions and bank repossessions.

Articles Updated 111923

'Zombie mortgages' could be attached to a property, even if they were charged off years ago

LOS ANGELES (KABC) -- Zombie mortgages: are they as terrifying as they sound? They could be.

Last month, Eyewitness News shared the story of Carson resident Adaina Brown. Her dream home is turning into a nightmare.

"It kind of just broke my heart," she said last month. "I told my husband, 'I can't take another thing.'"

When she and her husband bought the house in 2007, they needed a first and second mortgage. She said after property values plummeted, one of her lenders eventually charged off the second loan. She received a letter stating she was not responsible for the debt.

"'This debt has been charged off. You are no longer liable for this debt,'" Brown said as she recalled what was indicated in the letter.

But that's where it gets tricky.

Even if you are not responsible personally, a lien can still remain against the property. Another loan company now has that debt and says there is still an amount due of more than $139,000.

"The company that now owns that debt, whether it's a debt collector or a new loan company, is coming back after it because housing prices have risen and they're hoping to collect on that," explained Ali Hashemian, the President of Kinetic Financial.

After ABC7's report, the new loan company, Specialized Loan Servicing, or SLS, sent Eyewitness News at statement, saying in part "... There is a mortgage lien on the property that is intact and enforceable. A lien remains in place on the property in question until the debt is resolved through payment in full, an agreed settlement, or foreclosure."

It's like a horror story.

ByKinetic Financial President Ali Hashemian

Financial experts worry there are thousands of these so-called "zombie mortgages" handled by many different companies, and homeowners might not be aware of the consequences.

Articles Updated 111223

Thousands of veterans face foreclosure and it's not their fault. The VA could help

Becky Queen remembers opening the letter with the foreclosure notice.

"My heart dropped," she said, "and my hands were shaking."

Queen lives on a small farm in rural Oklahoma with her husband, Ray, and their two young kids. Ray is a U.S. Army veteran who was wounded in Iraq. Since the 1940s, the federal government has helped veterans like him buy homes through its VA loan program, run by the Department of Veterans Affairs.

But now the VA has put this family on the brink of losing their house.

"I didn't do anything wrong," says Ray Queen. "The only thing I did was trust a company that I'm supposed to trust with my mortgage."

Articles Updated 110523

What's Worrying New York's Banking Regulators? Plenty, Including CRE Loans

New York’s top financial regulator — Adrienne Harris, director of the state’s Department of Financial Services — has been vocal about a number of issues, including cryptocurrency regulation and better and faster bank oversight. And the state of CRE loans.

Harris stated in a recent Bloomberg TV interview that the “banking system is very stable” after the actions federal regulators took in March, closing several banks like Silicon Valley Bank and First Republic Bank in California and Signature Bank in New York.

But then she added that “there’s still lots of issues looming,” like risks from interest high interest rates, attending unrealized losses, and exposure to commercial real estate loans. “So, the regional banking crisis, I think, is over,” Harris added. “The banks are stabilized, but certainly we’re mindful of other risks in the system.”

Articles Updated 102923

Fines Levied: Oregon reaches $2.3B settlement with ACI

The Oregon Division of Financial Regulation (DFR) joined 43 other state financial agencies in reaching a settlement with ACI Payments Inc. (ACI), for erroneously initiating electronic transactions totaling $2.3 billion from the accounts of 480,000 mortgage-holders nationwide.

By the numbers

State regulators levied $10 million in fines through a multistate enforcement action. In Oregon, there were over 13,000 erroneous ACH entries affecting nearly 5,000 accounts. The dollar value of transaction in Oregon alone was over $23 million. Additionally, 50 state attorneys general, including the Oregon Attorney General Ellen Rosenblum, levied an additional $10 million in fines to ACI, in coordination with state regulators.

Articles Updated 102223

JPMorgan Chase Paid $1.085 Billion in Legal Expenses in Last Six Months; It’s Still Battling Hundreds of Charges and Legal Proceedings on Three Continents

At some point, federal regulators, the Senate Banking Committee and the criminal division of the U.S. Department of Justice are going to reach the same conclusion that Wall Street On Parade reached quite some time ago: JPMorgan Chase is a criminal enterprise in drag as a federally-insured bank.

Articles Updated 101523

U.S. Foreclosure Activity Shows Continued Rise In Third Quarter, Approaching Levels Seen Before Pandemic

IRVINE, Calif. – Oct. 12, 2023 — ATTOM, a leading curator of land, property, and real estate data, released its Q3 2023 U.S. Foreclosure Market Report, which shows there were a total of 124,539 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — up 28 percent from the previous quarter and 34 percent from a year ago.

The report also shows there were a total of 37,679 U.S. properties with foreclosure filings in September 2023, up 11 percent from the previous month and up 18 percent from September 2022.

Articles Updated 100823

Viewpoint: Consumers Deserve a Mortgage Bill of Rights

Lawmakers must strengthen protections to ease costs and counter harmful practices

Digging out from the 2008 housing crisis has not been easy. Americans were harmed by predatory mortgage lending practices, a collapse in home prices and a steep drop in the national homeownership rate. Since then, the U.S. housing market has experienced a slow but steady recovery.

Census data shows the national homeownership rate was 65.9% as of second-quarter 2023, up a full 3 percentage points since 2016. But challenges remain. The National Association of Realtors found that the gap in the homeownership rate between Blacks and whites is the biggest in a decade.

And a report this past June from the National Association of Homebuilders showed that while wage gains boosted affordability at the start of this year, the trade group’s first-quarter 2023 affordability index was still significantly lower than one year earlier.

When 30-year mortgage rates were in the 3% range, it was easier to overlook mortgage practices that harmed consumers. But now that interest rates have skyrocketed, protecting people from glitches in consumer protections should be more of a priority than ever.

This past summer, the Community Home Lenders of America released its Consumer Mortgage Bill of Rights. This document identifies specific areas where consumer protections need to be strengthened. Mortgage professionals should advocate for these positions to ensure a fair and thriving mortgage market.

Articles Updated 093023

Analysis of CFPB Complaints by State: Helping Consumers in New Hampshire

On October 3, 2023, the U.S. Supreme Court will hear oral arguments in Consumer Financial Protection Bureau (CFPB) v. Community Financial Services Association of America regarding the constitutionality of the agency’s independent funding structure. CFPB critics have long sought to limit the agency’s congressionally given autonomy and, by extension, its capacity to promote a fairer financial marketplace for all consumers. The Supreme Court’s decision in the case, which will come down next spring, could significantly harm consumers and spread uncertainty in the financial markets.

Since opening its doors 12 years ago, the CFPB has been a formidable advocate for everyday Americans, holding financial institutions accountable for predatory practices and returning $17.5 billion to wronged customers across the 50 states, including in New Hampshire.

Articles Updated 092423

Meet the Banking Cartel that Is Planting the Seeds for the Next Banking Panic and Bailout

On July 27, the Federal Reserve, FDIC and Office of the Comptroller of the Currency released a proposal to require higher capital levels at banks with $100 billion or more in assets – those that demonstrated quite clearly this past spring that they could spread systemic contagion throughout the U.S. banking system. Community banks will not be impacted at all by the new proposals according to the regulators.

The three federal bank regulators provided a very generous public comment period of 120 days on the proposal. (Submit your own comment here.) The large banks had to only begin transitioning to the new rules on July 1, 2025, with full compliance not due for an absurd five years – on July 1, 2028.

On September 12, the banking cartel made their anger known in a 7-page letter that assaulted the proposal from every conceivable angle and demanded that the three federal agencies turn over all “evidence and analyses the agencies relied on” in making the proposal.

Articles Updated 091723

CFPB Director Rohit Chopra Addresses Mortgage Post-Crisis Reforms and Importance of Consumer Protection Regulations

Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra recently addressed The Mortgage Collaborative National Conference recounting the Congressional response to the mortgage industry crisis that began in 2008 that resulted in the creation of the CFPB. Mr. Chopra emphasized that challenges to the validity and authority of the CFPB could hurt the stability of the U.S. housing market and broader consumer protections.

Mr. Chopra’s remarks began with a brief history of the 2008 mortgage market crash, and how the actions of IndyMac Bank resulted in one of the largest ever bank failures managed by the FDIC. In response, Congress shook up the federal financial regulators by shutting down the Office of Thrift Supervision and stripping authorities from a number of banking regulators, transferring these authorities to the CFPB.

Articles Updated 091023

Loan Servicing Software Market Trends Report 2023-2030 | 108 Pages Report

[108 Pages Report] "Loan Servicing Software Market" Market Size, Share and Industry Trends Analysis Report By Applications (Auto Lending, Title Lending, Mortgage),Types (Cloud-based, On-premise), By Regional Outlook and Forecast, 2023-2030. The report presents the research and analysis provided within the Loan Servicing Software Market Research is meant to benefit stakeholders, vendors, and other participants in the industry. The Loan Servicing Software market is expected to grow annually by magnificent (CAGR 2023 - 2030).

Articles Updated 090323

Attorney General Bonta Announces Settlement with Mortgage Servicer over Failure to Properly Process Military Reservists’ Mortgage Deferment Requests

OAKLAND – California Attorney General Rob Bonta today announced a settlement with The Money Source, Inc. (TMS), resolving allegations that the company failed to properly process, and timely grant, mortgage deferment requests made by California military reservists called to active duty. Under the California Military and Veterans Code, including the California Military Families Financial Relief Act (CMFFRA), reservists called to active duty can defer payments on certain financial obligations — including their mortgage, credit cards, property taxes, car loans, utility bills, and student loans — if they submit a written request and a copy of their military orders to the lender or other appropriate entity. Last year, the California Department of Justice (DOJ) received a credible complaint alleging that TMS mishandled a reservist’s mortgage deferment request. Subsequently, DOJ launched an investigation into TMS’s processes for handling mortgage deferment requests. As part of today’s settlement, TMS will pay $58,000 in penalties, fully reimburse the affected reservists, and be subject to injunctive terms.

Articles Updated 082723

ICE, Black Knight announce FTC agreement that clears way for $11.7 billion buyout

Intercontinental Exchange Inc. and Black Knight Inc. announced an agreement with the Federal Trade Commission late Aug. 25 that clears the way for ICE to complete its $11.7 billion buyout of Jacksonville-based Black Knight. The companies expect to close the deal Sept. 5, which is 16 months after announcing a merger agreement. The deal has been held up by FTC antitrust concerns that the merged company would control too much of the U.S. mortgage technology market. Black Knight dominates the market for processing home loans, with nearly two-thirds of all first mortgage loans in the U.S. processed through its system. Atlanta-based ICE is mainly known as the operator of the New York Stock Exchange but it also has a large mortgage technology subsidiary.

Articles Updated 082023

Oregon Bankruptcy Court Decides a Post-Foreclosure, but Post-Petition Eviction of a Borrower Violates the Automatic Stay

On August 4, 2023, the bankruptcy court for the District of Oregon determined that proposed actions by a lender to enforce a pre-bankruptcy petition foreclosure judgment and evict a borrower—after the borrower filed for bankruptcy—were in violation of the automatic stay. The court, however, did allow the lender the ability to pursue sanctions, criminal charges, and civil claims against the borrower for refusing to relinquish possession of the property after the bankruptcy filing (In re Natache D. Rinegard-Guirma, Case No. 22-31651-dwh13 (Bankr. D. Or. 2023)). This decision serves as a reminder of the broad protections of the automatic stay, while providing some avenues for relief for lenders far down the foreclosure and eviction process.

Articles Updated 081323

CFPB Report Details UDAAP Violations Uncovered During Recent Supervisory Examinations

On July 26, 2023, the CFPB released its Summer 2023 Supervisory Highlights, which focuses on alleged unfair, deceptive, and abusive acts or practices (UDAAP) violations found in recent supervisory examinations. The report also detailed violations caused by insufficient technology controls.

Mortgage Servicing. Servicers violated the Real Estate Settlement Procedures Act (RESPA)/ Regulation X by failing to evaluate complete loss mitigation applications and provide written notices of any loss mitigation options to borrowers within 30 days of receipt. Servicers also engaged in unfair or deceptive acts or practices by delaying processing of borrower requests to enroll in loss mitigation options, and by informing borrowers that the servicers would evaluate loss mitigation applications within 30 days but then move forward with foreclosure without reviewing the applications. Finally servicers violated RESPA/ Regulation X by: 1) not maintaining adequate procedures to ensure continuity of contact with delinquent borrowers; 2) not providing required information, including in cases where required language was included in English-language notices but not in Spanish-language versions; 3) not crediting payments sent to prior servicer after a transfer of servicing; and, 4) failing to maintain adequate policies and procedures to ensure that necessary information is transferred to the new servicer after a servicing transfer.

Articles Updated 080623

State urged to comply with Supreme Court ruling

BOSTON — The state’s Land Court is being asked to take steps to stop the practice of “equity theft” from homeowners who fall behind on their property taxes, in response to a recent Supreme Court ruling. In a letter to Chief Justice of the Land Court Gordon Piper, Holliston-based attorney Christopher M. Perry asks the court to take immediate “remedial action” to bring the state into compliance with the high court’s ruling in a Minnesota tax foreclosure case. He said the high court’s ruling made it clear that home “equity theft” is unconstitutional.

Articles Updated 073023

Home foreclosures rising with California, Florida in the lead

- Most foreclosures seen in California, Florida, Texas, New York and Illinois

- Eviction moratoriums expired, returning rates to pre-pandemic levels

- Average 30-year mortgage loan rate nearly 7% after latest Fed rate hike

The housing market is being impacted as the Federal Reserve raises interest rates for the eleventh time since March 2022, causing a spike in foreclosures. Eviction moratoriums protected families during the pandemic, but now, eviction rates in major U.S. cities are rising, returning to or surpassing pre-pandemic levels. Data from ATTOM Data Solutions reveals a rise in home foreclosures, impacting top five states from January-June 2023:

Articles Updated 072323

JPMorgan Chase Has Bled $230.6 Billion in Deposits Since Q1 2022, With Declines in 5 of the Last 6 Quarters

The data in the chart above comes directly from what the biggest bank in the United States, JPMorgan Chase, reported on its 10-Q filing with the Securities and Exchange Commission (SEC) for the quarter ending March 31, 2023. Despite all those mainstream media headlines and news stories about the biggest banks in the U.S. being the deposit beneficiaries of the banking panic earlier this year, the cold, hard facts on the ground are the following: at the end of the first quarter of this year, JPMorgan Chase had seen deposit outflows in four out of the past five quarters. Mainstream media conveniently forgot to mention that.

The only quarter in which JPMorgan Chase saw an inflow of deposits was the first quarter of this year, when three banks blew up: Silvergate Bank, Silicon Valley Bank and Signature Bank. That increase was a mere pittance compared to the huge outflows of deposits it had already suffered in 2022.

Now we are getting an even clearer picture of the downward trend in deposits at JPMorgan Chase thanks to the 8-K filing that the bank made with the SEC on July 14. Had it not been for that sweetheart deal that the FDIC cooked up with JPMorgan Chase in the second quarter of this year, allowing it to buy the good stuff it wanted from the failed First Republic Bank, while regulators ate the bulk of the bad stuff, JPMorgan Chase would have had another decline in deposits in the second quarter.

Articles Updated 071623

Only a tenth of mortgages have an interest rate above 6% — that’s a big problem for the U.S. housing market

Mortgage rates are inches away from 7% — but less than a tenth of U.S. homeowners have a home loan at that rate.

In fact, only 9% of all existing mortgages in the U.S. were taken out with a rate of above 6%, according to data from the Federal Housing Finance Agency, and analyzed by Torsten Slok, chief economist of Apollo Global Management.

Around a quarter of all mortgages — 23% — have a rate of less than 3%, Slok added, and 38% homeowners have a mortgage rate of between 3% and 4%.

In other words, the vast majority of U.S. homeowners have low mortgage rates.

Today’s home buyer vs. pandemic-era buyer

Articles Updated 070923

New York Courts Split on the Constitutionality of the Foreclosure Abuse Prevention Act

In the six months since New York’s governor signed the Foreclosure Abuse Prevention Act, L. 2022, ch. 821 (eff. Dec. 30, 2022) (FAPA), a split has emerged about whether the law applies retroactively.

FAPA strictly cabins the time limits for commencing mortgage foreclosures by amending five New York procedural rules (CPLR 203; CPLR 205; CPLR 213; CPLR 3217; RPAPL 1301) and the state’s General Obligations Law (GOL 17-105). The intent of the act, according to its sponsor, was to overturn certain precedent interpreting those rules and laws. Most significantly, FAPA invalidates the holding of Freedom Mortgage v. Engel, 37 N.Y.3d 1 (Feb. 18, 2021). In that case, New York’s highest court concluded that a mortgage holder may revoke a prior election to accelerate an installment debt (acceleration is generally a precursor to foreclosure), thereby preserving the option to accelerate again in the future. By undoing Engel, and other precedent too, FAPA takes away this and similar options from foreclosing plaintiffs.

Recent court decisions applying FAPA have varied as to whether or not the act’s effects may, constitutionally, be retroactive.

Articles Updated 063023

Tragic Death of JPMorgan Board Member Adds to the Bank’s String of Unusual Deaths

On Sunday, James S. Crown died in an unusual single-car accident, reportedly on a motorsport racetrack at a “member-owned country club” in Aspen, Colorado. The Pitkin County Coroner’s Office said in a statement that “The official cause of death is pending autopsy, although multiple blunt force trauma is evident.” The Sheriff’s Office indicated that the earliest new information would be made available to the public is next week.

In August of last year, Wall Street On Parade made a referral to the U.S. Department of Justice involving James S. Crown, who was a long-term member of the Board of Directors of JPMorgan Chase and two predecessor banks, Bank One Corporation (previously Banc One) and First Chicago Corporation. Following mergers between the banks, Crown seamlessly went from First Chicago (1991 to 1996) to Bank One (1996–2004) to JPMorgan Chase (2004 to the present) – a stunning tenure of 32 years for a Board Member dubbed an “Independent Director.”

Wall Street On Parade’s referral to the Justice Department concerned financial dealings between Crown and JPMorgan Chase that were not disclosed in public filings to the Securities and Exchange Commission or to shareholders. We reported at the time:

For more than a decade, JPMorgan Chase has been asserting in its proxy statement that its entire Board of Directors, other than Jamie Dimon, its Chairman and CEO, consists of independent directors. In its most recent proxy statement for 2022, JPMorgan Chase asserts that “The Board, having reviewed the relevant relationships between the Firm and each director, determined, in accordance with the NYSE’s listing standards and the Firm’s independence standards, that each non-management director…had only immaterial relationships with JPMorgan Chase and accordingly is independent”…

But JPMorgan Chase has failed to disclose the granular details of a string of financial dealings it has had with companies tied to its Board member James S. Crown, Chairman and CEO of Henry Crown and Company, a private company owned by Crown and his siblings that invest in a sprawling array of businesses…

Articles Updated 062523

Home Flipping Activity Remains High Across Nation As Investor Profits Show Signs of Improving in First Quarter of 2023

IRVINE, Calif. – June 22, 2023 — ATTOM, a leading curator of land, property, and real estate data, today released its first-quarter 2023 U.S. Home Flipping Report showing that 72,960 single-family homes and condominiums in the United States were flipped in the first quarter. Those transactions represented 9 percent of all sales.

The latest portion was down from 9.4 percent of all home sales in the nation during the first quarter of 2022. But it was still up from 8 percent in the fourth quarter of last year, hitting the second-highest level this century.

The report also revealed that while flipping activity rose, mixed trends emerged for raw profits and profit margins. Profits and investment returns both increased slightly from the fourth quarter of 2022 to the first quarter of this year. But both also remained near low points over the past decade, reflecting ongoing financial struggles for home flippers.

The quarterly gain in the typical profit margin, of 22 percent, represented a modest reversal of fortune for investors following three years of nearly continuous declines that began well before a slowdown in the broader U.S. housing market last year.

Articles Updated 061823

The CFPB intends to identify ways to simplify and streamline the existing mortgage servicing rules

Borrowing to buy a home is one of the biggest financial decisions a family will make. Mortgage servicers are the companies responsible for processing payments and managing mortgage accounts, and they play a critical role in assisting homeowners with repayment. Borrowers don’t choose these companies – servicers are chosen by the lender or investor that owns the mortgage.

In the mid-2000s, predatory mortgage practices spread throughout the country. Many large financial institutions with mortgage servicing operations experienced serious breakdowns. This resulted in a crisis where 10 million homes ended up in foreclosure between 2006 and 2014.

The foreclosure crisis was an important catalyst for the creation of the Consumer Financial Protection Bureau. Congress required the CFPB to implement new rules to make the mortgage market work better. These new rules first took effect in 2014. During the COVID-19 pandemic, we saw how these rules worked when unemployment spiked. The CFPB observed that there were places where the rules could be revised to reduce unnecessary complexity.

Articles Updated 061123

In search of the perfect foreclosure victim

Readers take issue with portrayal of Brooklyn homeowner battling lender

Home foreclosure stories, like eviction stories, trigger two very different reactions.

One is sympathy for the homeowner, who is enduring a traumatic, life-changing event that could have been avoided. Inevitably some observers call the lenders cruel, the courts uncaring and the politicians corrupt.

The other reaction is from those who consider foreclosures essential for a functioning housing market (foreclosure makes mortgages possible) and focus on the homeowner’s role. They look for evidence that the borrower made irresponsible decisions and should deal with the consequences.

Which brings us to a Gothamist story Wednesday about New York’s courts pushing foreclosure cases along without assessing — as state law requires — whether the homeowner can afford a lawyer or should be given free representation.

It’s obviously important for the court system which declined Gothamist’s request for comment to follow the law. Advocacy groups and a Brooklyn homeowner have sued to ensure that it does, the article reported.

But readers were more interested in why the homeowner, Carl Fanfair, stands to lose the Bedford-Stuyvesant brownstone he bought in 1999 for $200,000.

Gothamist reported that Fanfair, 47, fell more than $80,000 behind on his mortgage after losing his appliance-repair job in the pandemic and taking time to care for his wife and her elderly mother.

Fanfair, a Yoruba priest, told Gothamist the court referee at his settlement conference never considered his need for a lawyer, and his lender, Reliance First Capital, sent no information about a loan modification.

“There’s no personal type of interaction,” he told the reporter. “You’re just a number.”

Articles Updated 060423

Disgraced Silvergate Bank Hints It May Not Be Able to Cover All of Its Deposits; Fed Slaps It with a Cease and Desist Consent Order

Last week, on Tuesday, May 23, the Federal Reserve and California Department of Financial Protection and Innovation (the state banking regulator) hit the collapsed federally-insured bank, Silvergate Bank, and its parent, Silvergate Capital Corporation, with an enforcement action called a “Cease and Desist Consent Order.” The action was not announced to the public until yesterday.

A Consent Order is meant to function along the lines of a legal settlement, with the bank agreeing to the detailed terms of the Consent Order and waiving its right to judicial review. The individual signing the Consent Order on behalf of the bank was its controversial CEO, Alan Lane, who had allowed his federally-insured bank to get in bed with Sam Bankman-Fried’s house of frauds, including the FTX crypto exchange and Bankman-Fried’s hedge fund, Alameda Research. Lane also had allowed his deposit base to become heavily involved with other crypto-related companies.

Articles Updated 052823

US mortgage giants were placed on credit watch. Here’s what that means for home buyers

Washington, DC

CNN

—

The credit ratings of US mortgage giants Freddie Mac and Fannie Mae were put on watch for possible downgrade by Fitch Ratings late Thursday. A downgrade is not expected to happen, as a deal to resolve the debt ceiling standoff continues to be worked out in Washington, but even the warning is having an impact on mortgage rates.

The warning came because the ratings for Fannie Mae and Freddie Mac are linked to the sovereign rating of the United States. The watch is a result of the ratings agency warning on Wednesday that America’s credit rating could be downgraded if the debt limit showdown was not resolved soon.

Negotiations on the debt limit continue in the House of Representatives between mediators from the Biden administration and Speaker of the House Kevin McCarthy, R-Calif., at the Capitol in Washington, Wednesday, May 24, 2023. (AP Photo/J. Scott Applewhite)

The latest on the debt ceiling impasse

Fannie and Freddie, which guarantee roughly 70% of the country’s mortgages, do not directly issue mortgages to borrowers, but instead buy mortgages from lenders and repackage them for investors. They are each a government-sponsored enterprise, or GSE, chartered by Congress.

The aim of Freddie and Fannie is to provide liquidity into the mortgage market and enable a reliable flow of affordable funds to mortgage lenders. This ultimately allows more homeowners to borrow at more affordable rates.

The enterprises buy loans from lenders, pools them and sells them as securities to investors. Because they are backed by the government, these securities are viewed as less risky than other investments and considered to be as creditworthy as the US government.

But this flow of funds could be disrupted if the United States defaults on its debt, Fitch warned.

Articles Updated 052123

Fake Foreclosures Using the Fannie Mae Name

The central issue is not whether the homeowner owes a “servicer” any money. The central issue is whether the homeowner owes a creditor money.

Wall Street securities firms (Investment Banks) have many tricks by which they make fictitious claims appear to come alive. It is like those movies in which animated characters join the “Real-Life” figures. We accept this because we are there to be entertained, and we do not concern ourselves that neither animated characters nor the “real-life” characters are, in fact, real. They are imaginary, and we watch them to be entertained. And to be entertained, we must accept the story and characters as true.

Securitization and foreclosure are the same. The animated characters are those “mortgage-backed securities,” and the “real-life” characters are either fictional names of nonexistent entities or fictional use of names of business entities that technically exist but have no business interests in creating to a claim to collect money from anyone.

But in this case, the ticket price is always in six or seven figures. The homeowner may eventually lose the house to a non-creditor party, or the investors will lose their money by buying certificates that convey no interest in any loans. But this does not stop Wall Street intermediaries and sham conduits from being named by ignorant lawyers as being the parties on whose behalf a foreclosure is initiated.

One of the favorite tools used to force the sale of homesteads strictly for profit and not to pay off any debt is invoking the name “FANNIE MAE.”

Articles Updated 051423

A Holder is not a Holder in Due Course

The second requirement is usually completely ignored by the homeowner, the lawyers, and the judge. But it is still there. The possessor of the note, once that is established and confirmed by competent evidence, must allege and prove that it is authorized to enforce the note. By legal definition accepted in all jurisdictions, a holder is not a holder in due course even if they satisfy the two aforesaid requirements

Articles Updated 050723

We just want to stay in our home’: Springfield residents protest decision to foreclose a woman’s house

SPRINGFIELD, MA. (WGGB/WSHM) - A rally tonight in Springfield to keep one local woman’s house from being foreclosed. Dozens of Springfield residents came out to show their support for a local woman who’s fighting to stay in her house on Wednesday night. “We just want to stay in our home,” said Barbara Williams. Barbara Williams has lived in her Springfield house for more than a decade. After losing her job in 2016, Williams said Fannie Mae started the foreclosure process. “I purchased my house in good faith,” said Williams. “I lost my job and I fell behind in my payments. Now I have regained my income, I have remarried. I raised my children here and I had one child left at home when my house was foreclosed on.” Wednesday night, friends, neighbors, and community leaders gathered at her house protesting the efforts to take back Williams’ home. The rally was organized by the Springfield No One Leaves organization, which fights to keep locals in their home following foreclosures. “We’re always there to help,” said Sue Gamelli, one of the organizers. “We are not a service organization, what we teach you to do is to fight for yourself.”

Articles Updated 043023

CFPB Issues Guidance to Protect Homeowners from Illegal Collection Tactics on Zombie Mortgages

The CFPB release says “It is illegal for debt collectors to sue or threaten to sue to collect debts past the statute of limitations.”

The more subtle message is that Wall Street needs to stop making claims and threats on claims that either never existed or don’t exist anymore. And that is not just about the statute of imtiations. I would go further and say that anyone who uses that approach as a business model belongs in prison.

Consumers don’t know how legal debts are created, managed, serviced, or extinguished. They typically rely entirely on the statements, correspondence, and notes sent to them — even if those notices come on unsigned paper under the letterhead of business names with which they have never done business.

So the CFPB is catching up with an aspect of this and a fine nuance regarding the legal right to make claims or threaten action to collect an alleged debt. This time it is about Zombie mortgages. The success of the business plan depends entirely on convincing the consumer that his/her transaction was a loan, that an obligation was created, and that the instructions in the letter, statement or notice are authentic communications from a legally recognized creditor. In other words, the business plan requires lying to the consumer and convincing them to pay money when none is due, or there is no right to demand the money.

Articles Updated 042323

Black Knight's First Look: Mortgage Delinquencies Hit Record Low in March, While Prepayments Rose on Easing Rates and Seasonal Tailwinds

- The national delinquency rate dropped 53 basis points (-15%) in March, falling below 3% for the first time on record, ending the month at just 2.92%

- While delinquency rates almost always fall in March – as borrowers utilize tax refunds and other seasonal revenues to pay down past-due debt – the drop marked the second largest decline in the past 17 years

- Factoring in March's decline, the total number of past-due mortgages (including active foreclosures) has fallen to its lowest level in nearly 23 years, dating all the way back to April 2000

- Serious delinquencies (90+ days past due) showed marked improvement, falling by 51K to their lowest level since March 2020, with volumes shrinking in every state

- Likewise, every state saw overall delinquencies fall in March, with improvements ranging from 11.9% in Washington to 21.5% in Vermont

- Both foreclosure starts (+9.0%) and sales (+4.6%) rose in the month but still remain well below pre-pandemic volumes at the national level

- Active foreclosure inventory held steady, but remains 31K (12%) below March 2020 levels

- The prepayment rate (SMM) rose to 0.50% (+44% month over month) driven, as anticipated, by seasonal tailwinds in sale-related prepayments and an increased demand for refis due to falling rates

Articles Updated 041623

How to use the statutory definitions of the word “servicer”

Hat tip to summer chic. I might add a hat tip to some State and Federal agencies that are waking up and trimming the edges around the false claims implied to support the remedy of foreclosure. Things are changing — and before the banks manage to use their influence in state and federal legislatures, homeowners would be doing themselves and everyone else a favor if they went on the attack now.

Getting down in the weeds is what wins. For about 2 decades or longer, lawyers have been claiming to represent companies that are implied to be creditors and companies that are implied to be servicers. In truth, the lawyer does not represent either one, and neither of those companies has ever touched a single penny of the payments tendered by homeowners.

The word “servicer” has been used to define any company that claims to be a servicer and who satisfies one of several elements.

One element is that it claimed to have physical possession of the implied loan file, including the promissory note.

Although untrue, this has always been implied and largely unchallenged by homeowners, thus forcing the court to rule in favor of the lawyer implying the existence of a claim.

The second condition is always argued but never true. That is, the company implied to be processing payments from the homeowner has in fact been doing so. Therefore its records of such are admissible as business records, and those business records are easily admitted into evidence against the homeowner as an exception to the hearsay rule. Until 2022, this was a somewhat gray area.

But in 2022, the Consumer Financial Protection Board changed all of that. It said that any company that was in fact, receiving and processing payments from homeowners was a servicer. This made sense since the record of payments could only come from transactions between the company receiving the payments and the homeowner who tendered such payments.

But companies like CoreLogic et al (FINTECH) continue to argue that they are NOT servicers because they do not own or hold the implied underlying obligation or any documents pertaining to the transaction with the homeowner. Most homeowners and lawyers back off simply because they don’t know the next step. Here it is —-

Servicing means receiving any scheduled periodic payments from a borrower pursuant to the terms of any federally related mortgage loan, including amounts for escrow accounts under section 10 of RESPA (12 U.S.C. 2609), and making the payments to the owner of the loan or other third parties of principal and interest and such other payments with respect to the amounts received from the borrower as may be required pursuant to the terms of the mortgage servicing loan documents or servicing contract. In the case of a home equity conversion mortgage or reverse mortgage as referenced in this section, servicing includes making payments to the borrower. 12 USC 1024.2

Articles Updated 040923

Ocwen is seen as potential trouble!

Ocwen Related Matters

During the year ended December 31, 2022, Ocwen was our largest customer,

accounting for 41% of our total revenue. Additionally, 6% of our revenue for the

year ended December 31, 2022 was earned on the loan portfolios serviced by

Ocwen, when a party other than Ocwen or the MSR owner selected Altisource as the

service provider.

Ocwen has disclosed that it is subject to a number of ongoing federal and state

regulatory examinations, consent orders, inquiries, subpoenas, civil

investigative demands, requests for information and other actions and is subject

to pending and threatened legal proceedings, some of which include claims

against Ocwen for substantial monetary damages. Previous regulatory actions

against Ocwen have subjected Ocwen to independent oversight of its operations

and placed certain restrictions on its ability to acquire servicing rights.

Existing or future similar matters could result in adverse regulatory or other

actions against Ocwen. In addition to the above, Ocwen may become subject to

future adverse regulatory or other actions.

Articles Updated 033123

Friends and Foreclosure Fighters!

I have been blessed with what feels like kind of a sacred charge. I cannot accomplish this without as many people’s help as possible. (we need you to at least call in on Tuesday, 4/4/23 at 9am.)

This could be a milestone in the anti-foreclosure fight against what we now know is 160 years of predatory and prejudiced lending (one historic researcher holds that this is the primary reason for the continuing racial divide in wealth in the United States). The key Massachusetts courts, the Housing Courts, where the fight to end, reverse and redress predatory lending violations have begun a new practice of stripping not only the property rights and equal protection rights, but, in fact, First Amendment rights from those who fight illegal foreclosures and evictions.

I will be the first to address this fundamental stripping of First Amendment rights in oral argument. The universe has placed that hearing on, of all days, the 55th anniversary of the assassination of Martin Luther King, Jr. I had already planned to rely on his incisive and elegant formulation of the necessity of access to persuading others (freedom of speech).

What we need is an unprecedented magnitude of witnesses to this hearing. It is scheduled for Tuesday, 4/4/23 at 9AM ET. You can call in and listen to the proceeding: as the case is being heard in Session II, the phone number is 877-730-2624; passcode is 2530102#. Further, if you will contact me, please, and let me know if you can be there, there are further (and maybe better) ways to access the hearing. Please recruit friends and family – this matters.

Please, this is a potential watershed moment for this movement to make it clear that even if these illegal, immoral, and, in fact, criminal practices have been overwhelmingly ignored by our courts, it does not mean that we will put up with this injustice any longer.

In peace and power, love,

Grace Ross

MAAPL.org

617-291-5591

Articles Updated 032623

Florida cities ramped up foreclosures to hurt speculators. Instead they helped them

In 2015, then-St. Petersburg Mayor Rick Kriseman championed a plan to crack down on the city’s so-called “zombie properties” by aggressively foreclosing on them. The city would target poorly maintained properties that had racked up big fines and code enforcement liens with the hope that new ownership would lead to community redevelopment. City leaders believed the plan was the first of its kind in the state and signed a contract with a local private attorney named Matt Weidner to bring the city’s cases to court. Weidner had been a donor to Kriseman, a Democrat who was elected in 2013 after previously serving in the Florida House of Representatives. But Weidner brushed aside any concerns about impropriety.

“This is not a plum deal, which is going on forever or one that involves much money at all,” he said at the time. Weidner’s predictions, however, haven’t come to pass. Eight years later, he continues to bring foreclosure cases on behalf of St. Petersburg. To date, he’s been paid nearly $1.5 million by the city for his work.

And he’s signed contracts with eight other jurisdictions across Florida to do similar work since then, bringing in an additional $1.4 million in fees and expenses. Weidner has sold cities on the idea that they can transform code enforcement rules that used to be intended to achieve compliance into money-makers, by aggressively collecting money cities were owed from fines — or, in the alternative, taking the homes of owners who can’t pay.

The lawsuits have undoubtedly brought about improvements to many of the properties targeted, either through new, more active ownership or by forcing existing owners to improve their practices. But a Miami Herald investigation based on a review of thousands of pages of court records from more than 775 lawsuits and interviews with numerous property owners targeted by Weidner and his client-cities shows that they have also caused harm.

Articles Updated 031923

Mass. property tax foreclosure laws harmful, inequitable.

Last year, Deborah Foss was forced to live in her car during the coldest months of the year after New Bedford officials placed a tax lien on her home and sold it to a private company called Tallage for $9,626 — the total amount she owed, including interest. The tax lien gave the investor authority under Massachusetts law to take her home, sell it for $241,600 and keep all the profits. Deborah lost her home and her value in it over a debt that was worth just a fraction of the value of her home.

And that's just the tip of the iceberg. From 2014 through 2021, Massachusetts homeowners subjected to tax foreclosure lost 82% of their home equity on average — $172,000 per home. Massachusetts is one of 12 states, plus the District of Columbia, regularly using these abusive and unconstitutional “tax and take” seizures. A recent study by my firm, Pacific Legal Foundation, details how these predatory home equity theft laws work, and the windfall government and private investors have taken at the expense of people like Deborah.

Articles Updated 031223

How Bullshit Becomes Law: Circular logic in the courtroom snags homeowners almost every time.

If you don’t know the rules, you can’t win the game. And remember, to the foreclosure mills and faux servicers and faux trustees, this is all a game for which we pay every day as owners, taxpayers and consumers.

One of the interesting things about this is how much they get away with by NOT saying something. The affiant says something got mailed, but he doesn’t say that it was mailed by his employer, and therefore, he could not be relying upon ‘business records.”

But he MUST be relying on business records if the testimony for affidavit is to be accepted under the rules (laws) of evidence. Bank of N.Y. v. Morga, 2017 N.Y. Slip Op. 27107 (N.Y. Sup. Ct. 2017). So is he testifying about something he knows or suspects, or just reading from a piece of paper, the origin of which is a complete mystery to him? The inquiry leads to victory. Silence leads to defeat.

In addition, this underscores the problem with the way people and lawyers contest these false claims. By failing to contest the issues that rely on implied facts, homeowners admit them and make real (for legal purposes) that which is unreal. The goal is to stop the foreclosure — not put the opposition in prison.

This is why the QWR, DVL, and Complaint to the CFPB are so very important before filing anything in a legal proceeding.

Articles Updated 030523

Bank of America fights claims of discriminatory foreclosures

Homeowners in Hawaii and Florida accuse the bank of scheming to foreclose on their properties, but the bank says they haven't offered clear evidence it had anything to do with the foreclosures.

HONOLULU (CN) — Bank of America defended itself Friday at a motion to dismiss hearing on claims the bank deliberately foreclosed on mortgage loans as part of an extensive conspiracy to maximize profits at the expense of people of color in Hawaii and Florida.

The eight lead plaintiffs in the class action, a majority of whom are people of color, say they have been or are currently being foreclosed on, some for nearly two decades. They first leveled racketeering and Fair Housing Act claims against Bank of America and The Bank of New York Mellon in a July 2022 complaint. Although a majority of the plaintiffs’ foreclosure actions occurred in Hawaii, the suit also includes several plaintiffs who went through foreclosures in Florida. Three of the five Hawaii plaintiffs are of Native Hawaiian descent and the three Florida plaintiffs are women of color.

Articles Updated 022623

How to look and see the documents in mortgage and foreclosure cases

Here is my updated report to a client redacted as to particular facts and dates. I offer it as a model for how I look at these cases and how you can look at documents and arrive at conclusions that differ from what the documents say has occurred.

Keep in mind that all documents are hearsay and are not admissible as evidence without foundation testimony from a human being. That human being must have personal knowledge. The courts unfortunately have allowed testimony of “familiarity” instead of actual knowledge. That seemingly innocuous ruling has facilitated the greatest economic crime in human history.

Articles Updated 021923

Talking to a prospective lawyer when neither you nor he or she knows anything about securitization by Wall Street players, double-entry bookkeeping or accounting

Law students are taught only two forms of securitization: (1) divide an asset to sell to multiple investors or (2) divide ownership of the whole asset into multiple shares between investors. They are never taught anything about the dozens of other forms of securitization, most of which form the foundation of current practices. The main applicable form of securitization as it relates to transactions with homeowners neither splits the “asset” (i.e., the unpaid loan account on the ledger of a creditor), nor divides ownership of the entire “asset” into shares for multiple investors. This one fact accounts for nearly all the confusion on the part of lawyers and judges.

Articles Updated 021223

How Foreclosure Mills Win by Misusing “Judicial Notice”

Judicial Notice is a rule of evidence in which the court receives a written request to accept a document into evidence as proof of the truth of the matter asserted.

In Foreclosures, the truth of the matter asserted is that there is an unpaid loan account, and the named plaintiff or beneficiary has the right to administer, collect and enforce it. If that is alleged in a form that is allowed by law, and proven in the manner allowed by law, the foreclosure will be granted. I might add, that it should be granted to the extent that there is still an unpaid balance due to the named Plaintiff or beneficiary. But in nearly all foreclosure cases, this is NOT the true fact scenario.

There are circumstances where the trial court either MUST accept a document as evidence or in which the court can accept the document as evidence as to its existence. But unless there is an objection, the court will also presume that what is contained in the document is also true.

Articles Updated 020523

What are MSRs and why are they valued at $20 Billion?

MSRs are an abbrevation for a false label: Mortgage Servicing Rights. These rights are claimed by companies who perform no servicing functions and receive no paymetns from homeowners nor do they make any distributions to creditors. They are in it for the foreclosure, not the accounting and administration.

Articles Updated 012923

The tangled web to deceive

- The cancer that keeps eating away at the foundation of our economy is the current culture on Wall Street. It involves fake accounts, fake documents, and nonexistent transactions.

- It involves lawyers who are protected by litigation immunity and who promote false claims on behalf of claimants that have not hired them or even know they exist. We have seen such nonsense multiple times in history. It always ends the same —- with a crash. And apparently, the 2008 crash wasn’t enough because they are still doing it.

- With a hit tip to summer chic, here is an edited version of what she recently wrote to me.

- Lone Star reincarnated Countrywide into Caliber and BlackRock – into PennyMac

- There are at least 10-12 companies preying on each of us at any given time.

- Elle correctly said – investment banks are not involved in extortion from homeowners – directly. This is probably why Wells is “leaving housing market”

- They act via numerous intermediaries- hedge funds and fintech who in turn act via fake servicers and fake lenders.

- That is what Wall Street does – they establish the Scheme to sell securities.

- Then they destroy all documents about their transactions – after it was imaged and stored in Foley’s database ; and declare it “defaulted”

- Each prior transaction is stored in this database as defaulted.

- As many times as the property was sold, refinanced or modified , each time it creates a new string of securities- and this new transaction is named as “defaulted” right away and assigned to so-called “debt buyers” who of course did not buy anything and do not own anyone’s debt.

- The largest “debt buyer” is BlackRock, who merely is given access to Black Knight’s database and permission to steal as much as they can from homeowners under cover up of “servicers” who merely rent their names for correspondence and “billing statements “

- Hedge funds also don’t have access to money flow since it’s all done via BL, Fiserv and Exela.

- Each hedge fund has its own cohort of smaller fintech companies who receive passwords and instructions from main Fintech such as Bkack Knight and Fiserv.

- The players get paid by Wall Street banks after money is transferred offshore.

- All details should be investigated by DOJ who of course knows about it.

Articles Updated 012223

Don’t get lost in the weeds!

Anyone who watches the Madoff Ponzi documentaries knows that people deluded themselves out of greed. The basis of the Madoff scheme was a huge pile of documentation that was all fake. The “business” was taking money from investors and investing it. Madoff never made a single transction.

There was no such business. This is what happened and what is still happening with “loans” that are originated by investment banks though multiple layers of intermediaries. There is no loan business. There is only the business of selling securities. And in doing that, there is no balance due.

Millions of homeowners and thousands of lawyers have become lost in the weeds as they overlook the most obvious question: did this transction ever produce an unpaid obligation from the homeowner? Was that obligation ever purchased and sold in a transction between any assignor and assignee or endorser and endorsee?

The answer is simply NO! So why do homeowners and their lawyers inisist on paying it?

Articles Updated 011523

Wells Fargo suffered 50% profit loss during the fourth quarter

Following Wells Fargo's $3 billion penalty over a financial scandal, the bank reported a 50% loss in profit for the fourth quarter.

News of the profit drop affected Wells Fargo's remarket stock, which fell by 4% Friday morning.

The bank's quarterly earnings report indicated a 67-cent per-share profit for Dec. 31, which is significantly behind the $1.38 per share from the same period last year.

Articles Updated 010823

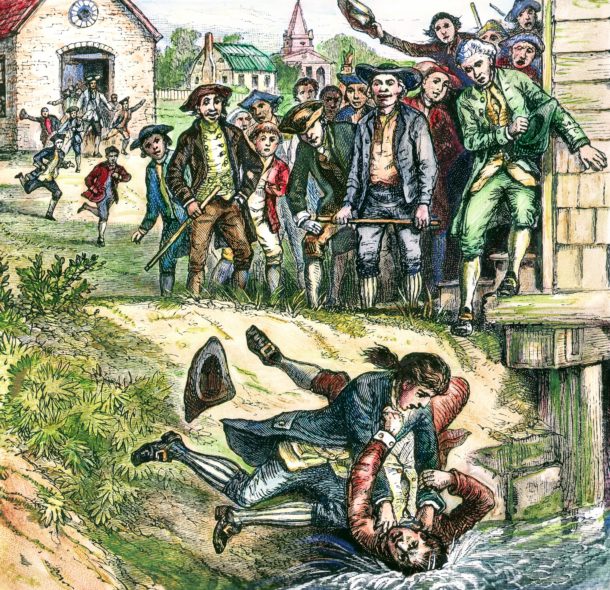

Then Again: After the Revolution, debt crisis triggered extreme unrest

Waging and winning a war with Britain had run the new nation heavily into debt. Worse yet, Britain seemed to take the whole business of losing rather poorly, and continued the conflict by inflicting economic pain on its former colonies. The British cut off American access to important markets in the West Indies, which would have helped the new country pay off its debts.

People felt the separation from Britain keenly when they tried to settle their own debts. When the British left, so did easy access to British coinage, which is what creditors demanded for repayment. They weren’t interested in bartering for goods or accepting paper money issued by the various state governments, because those notes were worth just a fraction of their face value. Therefore, many people faced debts they had no way of repaying.

Actually, courts ruled they still had one way to pay: Judges regularly intervened and foreclosed on debtors’ property.

From the creditors’ perspective, what was not to like about this arrangement? They got their money back. The people losing their farms, however, understandably felt differently.

In 1786, outrage over the debt crisis triggered some of the most extreme civil unrest the United States has seen. It also sparked uprisings in Vermont, which wasn’t actually part of the United States yet — it wouldn’t become a state for five more years.