|

||||

|

Audio-Video Coverage related to the Foreclosure Crisis The biggest and longest-running unpunished theft in history |

||||

|

occurs post loan origination when mortgage servicers use false statements and book-keeping entries, fabricated assignments, forged signatures and utter counterfeit intangible Notes to take a homeowner's property and equity.

|

||||

Foreclosure Judgments Void | Matt Weidner Law

|

Many of our judges have been suckered and hoodwinked by the Plaintiff firms, and its frankly unethical conduct.

Perhaps hundreds of thousands of foreclosures granted across the state of Florida and across the country have been granted when in fact the court file lacks the proper evidence necessary to grant foreclosure. | |||

The Crisis of Credit Visualized

| The Short and Simple Story of the Credit Crisis -- The Full Version | |||

Shocking ’60 Minutes’ Report Will Shake Wall Street To Its Core!

|

The bombshell ’60 Minutes’ report will shake Wall Street to its core. Exposing that Wall Street is rigged to the benefit of certain insiders who have made BILLIONS of dollars via computerized trading, this report should bring Wall Street to its knees.

Who are the victims? Everybody who has an investment in the stock market. | |||

How Insiders Rob Banks and Cause Crises) |

This is a great piece to share with friends and who still aren’t sure why we had a crisis or are predisposed to blame it on greedy borrowers, as opposed to greedy and reckless financial services industry players.

Bill explain how banks caused the financial crisis and why it was completely avoidable. Savings & Loan fiasco and Ameriquest mentioned. "Remember there is no Fraud exorcist. Once it starts out a fraudulent loan - it can only be sold to the secondary market through more frauds." | |||

|

|

Documents in JPMorgan settlement reveal how every large bank in U.S. has committed mortgage fraud. | |||

Exposing Massive Home Foreclosure FraudLynn Szymoniak 9/2012

| ||||

|

| ||||

|

"WE WERE TOLD TO LIE" - Bank of America Employee

| In an absolute bombshell filing in federal court, sworn affidavits describe an intentional strategy on the part of the Bank to systemically lie to struggling homeowners right up to the point of foreclosure. To hoodwink borrowers, stall for time and maximize the amount of money Bank of America got. Now, we've known for years in talking to the people on the receiving end of the bank's treatment that borrowers seeking loan modifications were strung along and screwed over. Now we have what appears to be the Smoking Gun. here's just a sample of what the Bank of America employees said under oath. Simone Gordon, senior collector, 2007 and 2012, "We were told to lie to customers and claim that Bank of America had not received documents it had requested and that it had not received trial payments when, in fact, it had. Employees were rewarded by meeting a quota of placing a specific number of accounts into foreclosure." | |||

THE PERFECT CRIMEUPDATE: The Murray family was wrongfully evicted from their home on May 14th by 3 armed deputies and 3 men sent by BoA to insure they were removed. | They asked for a modification of their adjustable-rate, high interest rate loan. The bank promised they could cut their payment in half and help them stay in their home. The only problem -- the bank lied. Instead of lowering it, they raised their payment by several hundred dollars per month, making it impossible for the Murrays to keep up. The very people who said they were helping them, were actually forcing them into foreclosure, and their house was sold on the auction block. | |||

10 years of illegal foreclosuresSame Story - Same NewscasterIn foreclosure - even though - they made all their payments on time.2002-2003: Mortgage Madness2013: Man fights to save foreclosing home

|

Martie Salt:

"This is really a stunning report. Image your mortgage company forcing you out of your home

- even though - you have never missed a payment and you have always paid on time. It sounds impossible, but thousands of homeowners are facing that

very same threat from a huge home lender, and many of those victims are right here in central Florida. ACTION 9 investigates a case of mortgage madness that really could

threaten just about anybody."

| |||

|

Martie Salt: "An Orlando father is worried he could lose his home - even though - he has always made all his payments on time and sometimes has even overpaid." He said Wells Fargo offered him a mortgage modification but decided to foreclose on him after he made the payments. The question is: "How can the bank get away with doing something like this?" | ||||

DEATH by FORECLOSURE

Actual Good News: Foreclosure Solutions

|

The most scandalous story about a 62-year-old disabled veteran whose neighbor and friend filed suit this week against Wells Fargo the bank that owned his mortgage for wrongful death. He died in December in a courtroom during a hearing challenging his foreclosure with Wells Fargo. And he never should have been in this court to begin with.

_________________________ A nonprofit found a way to keep people in their homes and communities in tact. using a 25 million loan to buy homes from people in default or subject to foreclosure and reselling the homes back to the owners at affordable mortgages. | |||

The Secret of Oz

|

The world economy is doomed to spiral downwards until we do 2 things: 1. Outlaw government borrowing; 2. Outlaw fractional reserve lending. Banks should only be allowed to lend out money they actually have and nations do not have to run up a “National Debt”. Remember: It’s not what backs the money, it’s who controls its quantity. | |||

Foreclosure settlement: a nationwideCrime Scene |

4/9/13: Banks are foreclosing on military members, on people who had been approved for a loan modification, and even on people who were never behind in their payments--all part of an astounding settlement that shortchanged millions of homeowners and left hundreds of thousands wrongfully ejected from their homes.

Documented cases of homeowners who are current on their payments being successfully foreclosed on. not just having foreclosure proceedings against them, but people making their payments, paying their mortgage and have their homes taken from them for now no. reason. | |||

FORECLOSED & RANSACKED |

Crime, suicide, grand theft, civil rights, lawlessness. How bad is it? This video will tell you. | |||

US Banks Operate an Illegal Home Foreclosure System, Unfettered | It's massive, it's criminal, it's wrong, and its proven with what lawyers call a mountain of evidence. | |||

|

We The People Stimulus Package

The Government Ignored You - and You Did Nothing

| Bob Basso author of "Common Sense" plays the role of Thomas Paine to ignite the fire of change in America. Patriotism and Pride for America lead Thomas Paine to help take back America! | |||

|

Foreclosures on People Who Never Missed a Payment

The Real News interviews Yves Smith

|

Yves Smith: Mortgage service industry makes more money from foreclosures than restructuring debt.

"... a significant number of their clients facing foreclosure has (sic) made every single mortgage payment." Academics have been writing about this since 1998! | |||

Matt Taibbi on Big Banks’ Lack of AccountabilityFebruary 1, 2013 | “The rule of law isn’t really the rule of law if it doesn’t apply equally to everybody. If you’re going to put somebody in jail for having a joint in his pocket, you can’t let higher ranking HSBC officials off for laundering $800 million for the worst drug dealers in the entire world,” Taibbi tells Bill. “Eventually it eats away at the very fabric of society.” | |||

FRONTLINE The Untouchables

|

FRONTLINE investigates why Wall Street’s leaders have escaped prosecution for any fraud related to the sale of bad mortgages.

Commenting on clips from the episode showing former home loan underwriters explaining how they would laugh as they pushed through mortgages that were too expensive for the borrowers, Smith said this type of behavior was "very frequent and common." 2:20 The men and women who duped would be homeowners; who defrauded American investors need to be indentified, prosecuted, convicted and thrown in jail. - Senator Ted Kaufman | |||

Mortgage Crisis in a Nutshellpresented by attorney John Campbell

|

In this one-hour video, Attorney John E. Campbell explains the main aspects of the mortgage crisis that has devastated the U.S. housing market and the economy. This video was produced by John Campbell and Erich Vieth, who are both attorneys with the Simon Law Firm in St. Louis, Missouri. A substantial part of their law practice concerns issues pertaining to mortgage fraud and unlawful foreclosures. They have filed numerous individual and class action lawsuits on behalf of behalf of homeowners. | |||

|

MUST WATCH!

|

The confusion of foreclosure cases is exemplified

here. Seven lawyers signed complaint; one spouse signed the Note; Fraud

upon the court; MERS, assignment 4 years late...

Judge: "If the trust does not give Wells Fargo the right to litigate….THEN THEY ARE OUT OF COURT" "I hate to spin into the abyss…but Freemont Investment and Loan is not a legal entity is it? | |||

|

HOME LOANS FROM HELL Dual Tracking

|

MUST WATCH!

Criminals are stealing homes, and not a soul is stopping it. This is craziness! It is shameful and inexcusable that after 15 - 20 years, America is still hearing the same stories because judges. lawyers, law enforcement and government are criminally aiding these criminals. | |||

|

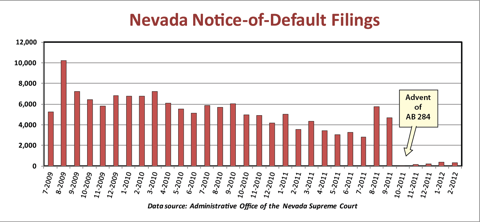

If all states had enacted a law similar to Nevada's

AB 284 back in the early 1990s, it may have prevented our

Foreclosure/Financial Crisis ?

h/t Mandelman Matters |

This stunning visual shows Nevada's Notices of Default filings before and after AB 284 passed. In October of 2011, the State of Nevada made national news when it passed a law related to foreclosures known as Assembly Bill 284. It was often referred to as Nevada’s “robo-signing law,” because among other things, the law made it a "felony" for loan servicers to sign documents without “personal knowledge” of who owns the note, and it further required lenders to provide an affidavit showing they have the authority to foreclose. | |||

|

FORECLOSURE STOPPAGE

All of his clients still live in their homes

|

Homeowner stopped paying when her mortgage company went out of business and she didn't know who to pay. Months later, she got a foreclosure notice from a bank she had never even heard of. Lawyer who does title searches says he has never seen a Note. Nobody owns these debts in a way that they are subject to legal enforcement. April Charney This is not a stall tactic -this is a tactic about winning. It's about stopping the clock altogether. | |||

|

Bloomberg Interview with Chris Whalen

"Foreclosure Issue is a Cancer"

|

The impact of U.S. mortgage foreclosures on banks and the housing market and the outlook for the economy.

| |||

|

Homeowners, Advocates Want BANK REPS and LAWYERS "Our investigation finds many of those foreclosures didn't have to happen. They were actually done ILLEGALLY. "

_______________________________________________________ The average homeowner would be indicted. The five major banks - nothing happens. And you have to wonder why. |

Courts know about the problem, and so does law enforcement; but no one has been held criminally responsible for what some call

"the largest fraud ever perpetrated on

Americans." Register John O'Brien's office no longer accepts assignments signed by known Robo-Signors. His staff returns them to the bank with an affidavit asking bank officials to swear to their authenticity. He says - no bank has ever done so.

| |||

|

"These banks acted as a criminal enterprise. They crossed state lines, they recorded fraudulent documents, they committed forgery and they committed mail fraud. They used the United States Postal Service to mail these documents to Registries of Deeds." - John O'Brien Salem County, MA Register of Deeds | ||||

|

SGT Report: You Probably Don't Even Own the House You Are Paying For |

In 2012, when we think Wall Street we think: MF Global theft, JPM criminality, Goldman naked shorting, DTTC failures to deliver, precious metals manipulation, fractional reserve banking, Comex games, HFT trading and endless derivatives. But don't forget about MERS and mortgage fraud - because according to Vermont Trotter, the National Director of 'Protect Americas Dream' it's all tied together in one giant Ponzi scheme. The worst part is, the bank you pay for your mortgage probably does not even hold the title to your home. It's a mess - and we are ALL victims. | |||

|

'Impressive' Oral Argument before the Washington State

Supreme Court

BAIN v. MERS

** This is a landmark case where MERS lost. ** |

Oral arguments: Bain v. Mortgage Electronic Registration Sys, et al and Selkowitz v. Litton Loan Servicing, LP, et al. (May a party be a lawful beneficiary under WA's Deed of Trust Act if it never held the promissory note secured by the deed of trust?) | |||

|

Fault Lines - For Sale: The

American Dream

|

For Americans emerging from the foreclosure crisis, the firm line that once separated the security of homeownership from the insecurity of homelessness was suddenly blurred. "Back in the 30s, they created public housing to catch people who could become homeless because of the foreclosure crisis. Today, we're in a similar time, people need a safety net but it doesn't exist anymore. | |||

|

RAPE & PILLAGE: The TRUTH BEHIND The GOVERNMENT/BANK LOAN MOD SCAM

|

Treasury told the banks if you convert this into a permanent mod, you will have to waive all the fees. But if you foreclose and pull the rug out from under the homeowner, you actually get to keep all those fees and can cash them in during the foreclosure sale. We have been set up for even more disasters. | |||

|

SHOCKING VIDEO!!!

Australia’s Sub Prime Mortgage Scandal Grows

|

Australia’s largest banks are being forced to "forgive mortgage debts" of borrowers granted loans based on falsified or fraudulent information supplied by mortgage brokers. From the transcript: KATE THOMPSON: I do not think there was a bank or non-bank lender that wasn’t doing it. I – from my files alone, I am certain I could evidence every single bank. In 2007, Kate Thompson was WA Mortgage Broker of the Year. Now, she’s facing fraud charges. These people are losing their homes and there is nothing I can do except tell it like it is. | |||

|

It’s Over For The Global Banking Cabal

|

These large banks have stolen money from every single human on the planet. Not one person was left out. Not even YOU! Now that it is exposed there is no going back. We will ALL support the “NO MORE BAILOUT” mantra… | |||

|

|

If you have never heard what Catherine has to say about our current crisis… well, you’d be insane not to take advantage of this opportunity. Because as she’ll explain, it wasn’t an accident, it’s been in the cards, as they say for so long I’m not even going to tell you how long, except to say that it has something to do with Iran-Contra. | |||

|

Catherine Austin Fitts : Deliberate Implosion of the U.S. Economy

Fitts explains how every dollar of debt issued to service every war, building project, and government program since the American Revolution up to around 2 years ago -- around $12 trillion -- has been doubled again in just the last 18 months alone with the bank bailouts. "We're literally witnessing the leveraged buyout of a country and that's why I call it a financial coup d'état, and that's what the bailout is for," states

Fitts. |

Former Assistant Secretary of Housing under George H.W. Bush Catherine Austin Fitts blows the whistle on how the financial terrorists have deliberately imploded the US economy and transferred gargantuan amounts of wealth offshore as a means of sacrificing the American middle class. Fitts documents how trillions of dollars went missing from government coffers in the 90's and how she was personally targeted for exposing the fraud. | |||

| How Big Banks Victimize Our Democracy |

June 22, 2012

MATT TAIBBI: There's vast criminality in Wall Street now. It's bribery, theft, fraud, bid rigging, price fixing, gambling, loan sharking. All of these things, it's all organized. | |||

| Abacus Bank Indicted for Mortgage Fraud |

Last week Manhattan DA Cy Vance filed charges against Abacus Bank and 19 former employees for committing mortgage fraud. Does this mean more prosecutions of other banks for crimes committed prior to the housing crisis? Probably not, according to Bill Black, former regulator and current professor at University of Missouri-Kansas City. Bill tells Bloomberg Law's Lee Pacchia that there is a profound lack of resources in state and federal government to investigate and prosecute banks and employees for mortgage fraud despite substantial evidence of criminal activity. Bill also claims that Treasury Secretary Timothy Geithner has discouraged regulators and prosecutors from pursuing large banks for malfeasance and fraud. | |||

|

FORGED

SIGNATURE WIPES OUT MORTGAGE

|

With the help of attorney Omar Arcia, she won her case. The lender decided to stop all legal proceedings against her because the documents were deemed fraudulent . Castro now owes nothing. | |||

|

|

Episode One Inside the epic rise of a new financial order -- and the trouble that followed. Episode Two

| |||

BLUEPRINT FORACCOUNTABILITYThe Wall Street-Washington Connection The Wall Street-Washington Connection from Culture Project and Lannan Center on FORA.tv |

From Georgetown University Accountability is critical to democracy. At a time when grave challenges threaten American democracy, Culture Project presents “Blueprint for Accountability,” a series that asks “How can we empower ourselves to hold our leaders–in government, education and corporate institutions–accountable for the events of the past and the conditions of the future?” With Eliot Spitzer, Matt Taibbi, Ron Suskind, Van Jones, Heather McGhee, Jesse LaGreca | |||

|

|

In a stunning move that has civil libertarians stuttering with disbelief, the U.S. Senate has just passed a bill that effectively ends the Bill of Rights in America. This bill, passed late last night in a 93-7 vote, declares the entire USA to be a "battleground" upon which U.S. military forces can operate with impunity, overriding Posse Comitatus and granting the military the unchecked power to arrest, detain, interrogate and even assassinate U.S. citizens with impunity.

| |||

|

IndyMac-West One Bank Mortgage FRAUD and the Complicity of the Courts

|

This is most certainly not your average bank mortgage fraud story... this is my shocking true story of malicious victimization at the hands of IndyMac/West One Bank & counsel, their blatant fraud, and the complicity of the courts. | |||

HUGE Oakland County Win Against Fannie and Freddie

|

Oakland County is celebrating a major win over mortgage giants Fannie Mae and Freddie Mac. “They’ve cheated,” Meisner told Action News on Saturday. “It’s cost us Billions of dollars, and this is about taking one step toward recovering that and fighting back against the foreclosure crisis.”

| |||

|

| ||||

Standing up to BanksPutting who owns what back in order.

"If these documents are certified by my office and used in court proceedings; if they are not right - it is fraud upon the court." - County Registrar Jeff Thigpen

| ||||

Gretchen Morgenson: Wall Street Really Does Enjoy A Different Set of Rules Than The Rest of Us

| ||||

Bank of America’s phony mortgages are as fraudulent as fake Prada purses — and they get away with it

| ||||

|

VIDEO TEACH IN | 100 FACTS ABOUT SECURITIZATION WITH LYNN SZYMONIAK AND LISA EPSTEIN

| ||||

|

Attorney General Kamala D. Harris Announces Homeowner Bill of Rights

|

The legislation is designed to protect homeowners from unfair practices by banks and mortgage companies and to help consumers and communities cope with the state's urgent mortgage and foreclosure crisis.

Joined by Senate President pro Tem Darrell Steinberg and Assembly Speaker John A. Pérez, Attorney General Harris announced her sponsorship of six bills designed to guarantee:

| |||

|

| ||||

|

"We don't want to be a warehouse of stolen property."- NC County Register Jeff Thigpen North Carolina County Register Jeff Thigpen discusses the false documents filed in his county. | ||||

|

from HARRY's LAW

A small clip from an episode of Harry's Law. A women who lost her house due to the mortgage crisis, and her bank screwing her over with refusing to work something out, and makes a statement by robbing her bank. |

||||

|

The LIES of 2008

More from 2008: Who Caused the Mortgage Meltdown |

||||

|

This Video describes how the public reacted to evictions during the 1930's...

|

||||

|

||||

|

HOUSE OF PAIN

AG Coakley "also accuses these banks of forging documents and basically STEALING HOMES by virtue of their inability to legally prove the right to FORECLOSE by virtue of the documents that indicate their ownership . It has actually become impossible in the current system to answer that question."

|

||||

|

BOMBSHELL: A Tale of Two Attorney Generals…. California and Florida One Fights For Consumers - One Fights For Banks from attorney Matt Weidner

After AG Bondi took office, foreclosures in foreclosure ravaged Florida jumped 150%! |

||||

|

Occupy LA Teach In with Professor William K Black

|

||||

|

Nevada's Catherine Cortez Masto

Once Nevada made it a crime (a felony) to file improper paperwork with the courts, subject to 10 years in jail and fines of $10,000 per violation...

|

||||

|

Attorney Tom Cox testifies about the robo-signing scandal; GMAC's attempts to cover it up and tried to sanction Mr. Cox for sharing his findings in the Jeffrey Stephan deposition. |

||||

ROAD TO RUIN: Mortgage Fraud Scandal Brewing

Criminal fraud may be the most underreported aspect of our current financial crisis. In this "Road to Ruin" report, former subprime lenders from Ameriquest, once the country's largest lender, describe a system rife with fraud. They describe how a "by-any-means-necessary" policy pushed employees to cut corners and falsify documents on bad mortgages and then sell the toxic assets to Wall Street banks eager to make fast profits. |

||||

|

|

||||